A Bit of History

The Dalmore was founded in 1839 by Alexander Matheson and is in the small Highland town of Alness, around 35 minutes north of Inverness. However, arguably the most significant date in Dalmore’s history came in 1867 when Andrew and Charles Mackenzie began working at the distillery.

The brothers became sole owners in 1891 and introduced their family emblem to the distillery – the 12-point stag. This has become synonymous with The Dalmore and stems from a story dating back to 1263 – the Chief of the Clan Mackenzie, Colin of Kintail, saved King Alexander III from a marauding stag. The King awarded the Mackenzie family the symbol of the beast as thanks.

Mackenzie Brothers Ltd merged with Whyte & Mackay in 1960 and this began The Dalmore’s long association with the famous blending company. The distillery remains owned by Whyte & Mackay, which is now part of the larger Philippines-based Emperador Inc. They took control in 2014 and own the Whyte & Mackay blended whisky brand, plus the single malt distilleries of Fettercairn, Jura and Tamnavulin.

Background

For much of its history The Dalmore has been a blending malt. Occasional single malt bottlings were released, and these helped to create early consumer interest in the brand. Since the 1960s the distillery has supplied much of its whisky to the popular Whyte & Mackay range of blends.

The 1990s saw a strategy to establish The Dalmore as a single malt brand by the ownership. This accelerated in the early 2000s with the current premiumisation really ramping up in the latter part of the decade. Now The Dalmore is positioned as one of the most prestigious and most luxurious of all Scotch single malts. This is supported by an award-winning core range and numerous old, rare and limited-edition releases.

The Geeky Bit

The Dalmore is currently a bit of a building site with the distillery in the final stages of a major renovation and expansion. This will see a new still house where the former maltings were housed, with the remainder of the distillery reconfigured. A new visitor centre is also being constructed. The result will see annual production levels almost double to nine million litres. The new set-up will feature two mash tuns, 17 washbacks and eight pairs of stills. It is expected to be operational from Spring 2025.

In contrast, the old distillery distils just over five million litres of spirit per year. It has one 10.4-ton stainless steel mash tun, eight Oregon pine washbacks with a fermentation time of 50 hours and four pairs of stills. The spirit stills are unusual in that they are equipped with water jackets. This increases reflux within the still – this process re-condenses alcohol, which runs back into the still and gets re-distilled. The water used in production is taken from Loch Morie. This flows 10 miles from the loch to the distillery via the River Averon.

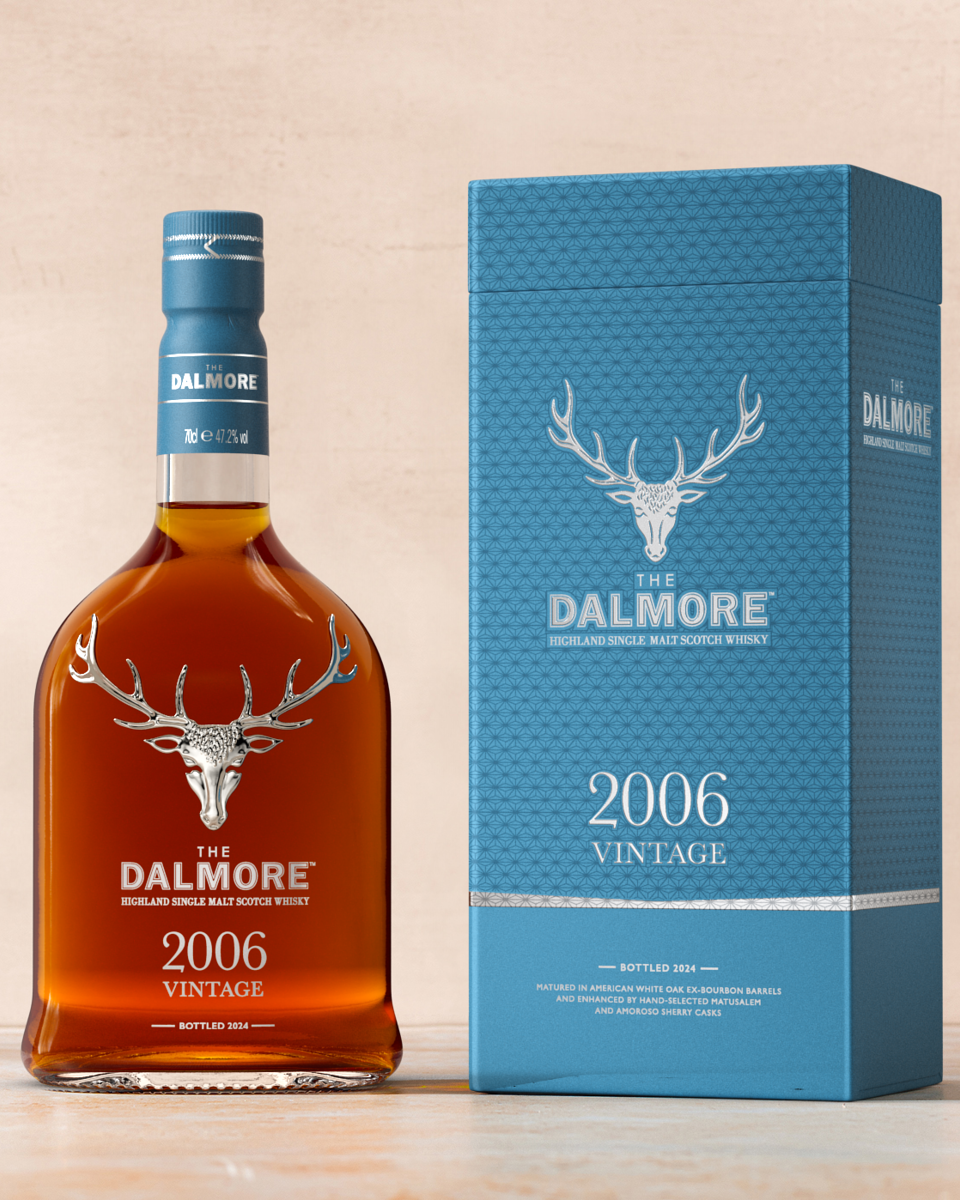

One To Buy | The Dalmore 2006 Vintage

The Dalmore Vintage 2006 is an 18-year-old single malt that forms part of the distillery’s annual Vintage Collection. The series showcases some of the best whiskies maturing in The Dalmore’s warehouses. This bottling has been matured in American oak ex-bourbon barrels with a dual finish in ex-Matusalem sherry and ex-Amoroso sherry casks.

The limited-edition whisky is bottled at 47.2% ABV and is of natural colour and non-chill filtered. The Vintage 2006 is rich, luxurious and decadent. Expect notes of milk chocolate, orange marmalade and toasted hazelnut married with caramel, Cognac-soaked raisins and plenty of drying wood spice.