A bit of history

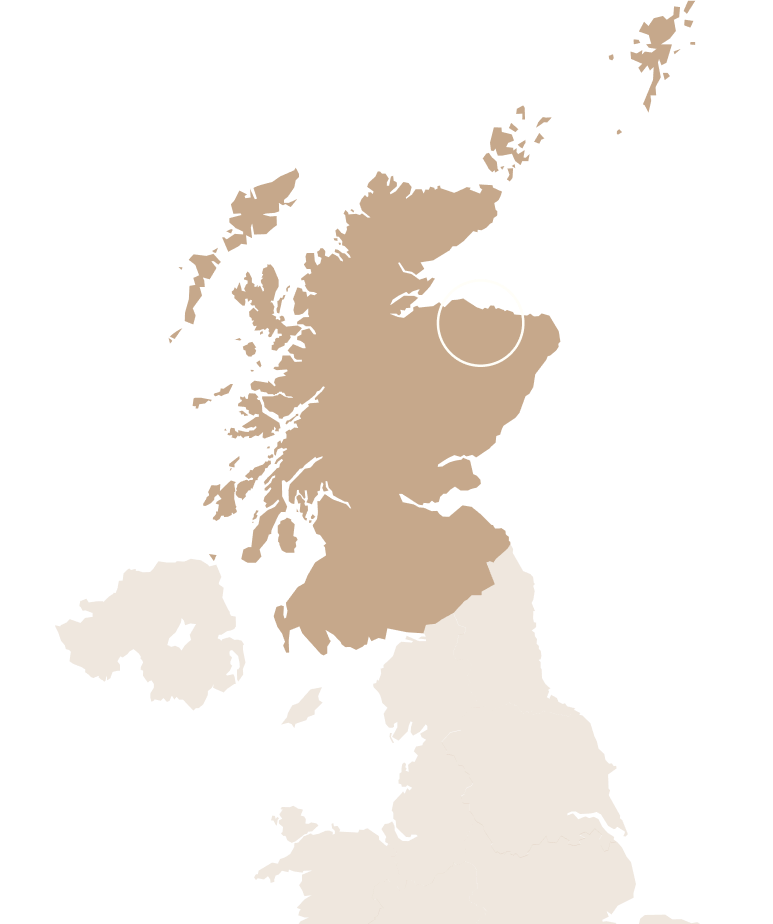

Tamnavulin is a child of the sixties, having been established and built in 1966. The company was named the Tamnavulin-Glenlivet Distillery Co. after the local hamlet of Tamnavoulin and its proximity to the famous Glenlivet distillery. The company was a newly created arm of Invergordon Distillers Limited and responded to a boom in the Scotch whisky industry during the late-1950s and early-1960s.

However, after less than 30 years, Tamnavulin was mothballed in 1995. This is the practice of ceasing production at a distillery for an indefinite period but leaving everything intact to begin distillation when required. Bar a few weeks of production in 2002, it remained closed until 2007. This is when United Spirits purchased Whyte & Mackay and restarted production. Whyte & Mackay is now part of Emperador Inc. who took control in 2014. The first official single malt for over two decades – the Tamnavulin Double Cask – was released a couple of years later in 2016.

Background

As with most Speyside distilleries outside of the big names, Tamnavulin was built to supply single malt whisky to several blended brands. What makes Tamnavulin particularly desirable to Master Blenders is its light, floral and grassy nature. The new make spirit shows notes of green apple and pear, dried hay and fruit blossom. These characteristics pop when married with bolder styles of single malt.

Historically, Tamnavulin has been a major ingredient in several major blended Scotch whiskies, most notably the range of Whyte & Mackay. While this remains, a change in focus has led to the development of a single malt range. This has explored the boundaries of cask finishing while staying close to Tamnavulin’s Speyside roots. A series of tasty whiskies using ex-white or red wine casks have helped push the brand in its positive direction. It currently sells just over two million bottles worldwide per year.

The geeky bit

Tamnavulin is a relatively large and modern distillery with an annual production capacity of 4.3 million litres. It boasts an 11-tonne mash tun and runs 22 mashes per week. This feeds nine stainless steel washbacks, with a fermentation time of 60 hours. There are three pairs of stills – 3x wash stills with horizontal lyne arms and 3x spirit stills with descending lyne arms.

A high cut point within the spirit stills gives Tamnavulin its light and grassy character. In 2018 a new bioplant and other modifications were installed to reduce the environmental impact of the whisky making process. Water for production is drawn from underground springs close to the distillery.

One to buy | Tamnavulin Double Cask

This single malt was the first to officially be bottled by the distillery for more than 20 years when it appeared in 2016. It has now become the cornerstone of the core domestic range. The name refers to two cask types used during maturation – firstly American oak ex-bourbon barrels and then a finishing period in ex-sherry casks.

The two cask types, plus Tamnavulin’s light and grassy spirit, combine to give a classic soft and gentle Speyside flavour profile. Notes of crisp green pear, fairground toffee apple and zesty lemon lead the way, and are quickly joined by further notes of vanilla, gingerbread and juicy sultana. All are supported by an underlying maltiness and a pinch of warming baking spice.

To find out how to invest in your own cask of Tamnavulin whisky, get in touch with one of the Whisky 1901 team.

**Disclaimer**

Whisky cask investments are unregulated in the UK. The value of investments is variable and can go down as well as up. You have 14 days to change your mind and request a full refund under our cooling-off period. The volume of spirit will decrease over time (known as “the Angels’ share”). “New Make” spirit has to be matured for 3 years, during which time its alcoholic strength could be reduced. However, for the product to be classed as “whisky”, it must retain a minimum strength of 40%. Fees apply, see terms and conditions for details and terms around exiting your investment.

An investor may get back less than the amount invested. Information on past performance, where given, is not necessarily a guide to future performance. The capital invested can fluctuate and the price of casks can go down as well as up and is not guaranteed. The investments and services offered by us may not be suitable for all investors. If you have any doubts as to the merits of an investment, you should seek advice from an independent financial advisor. The Whisky 1901 Ltd sale price includes a discretionary markup to cover the cost of services provided, including but not limited to, storage, movement and maintenance of casks, insurance, front and back-office software.